Ideal Info About How To Apply For Canada Child Tax Benefit

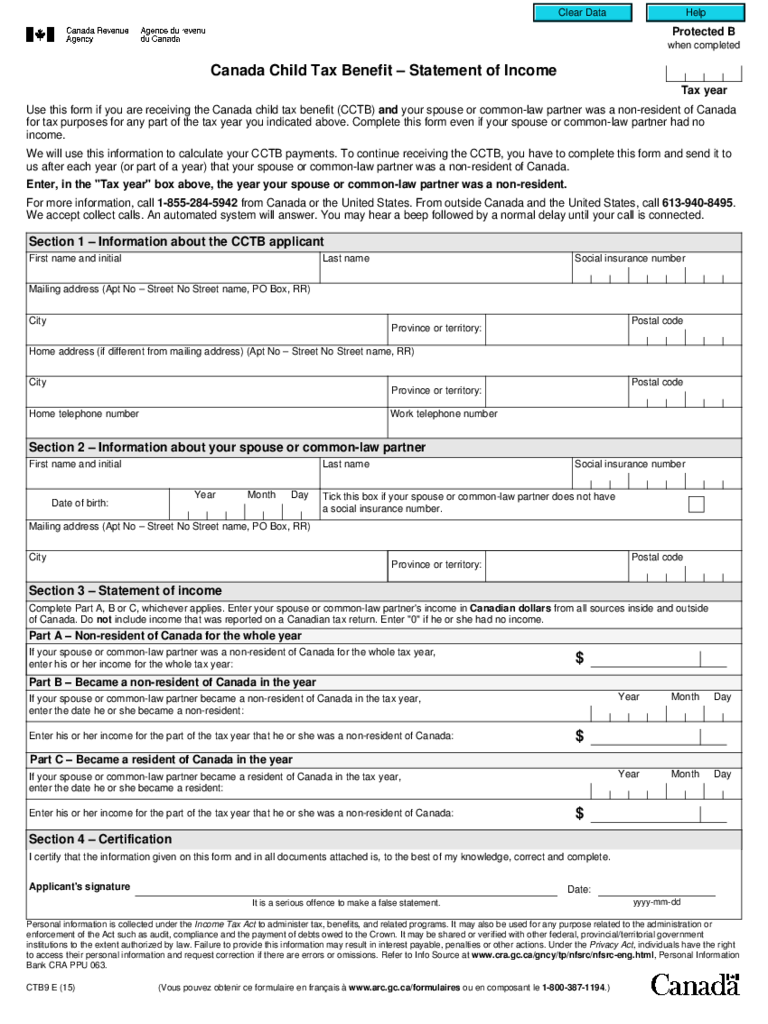

Contact the canada revenue agency by phone if you have a question regarding.

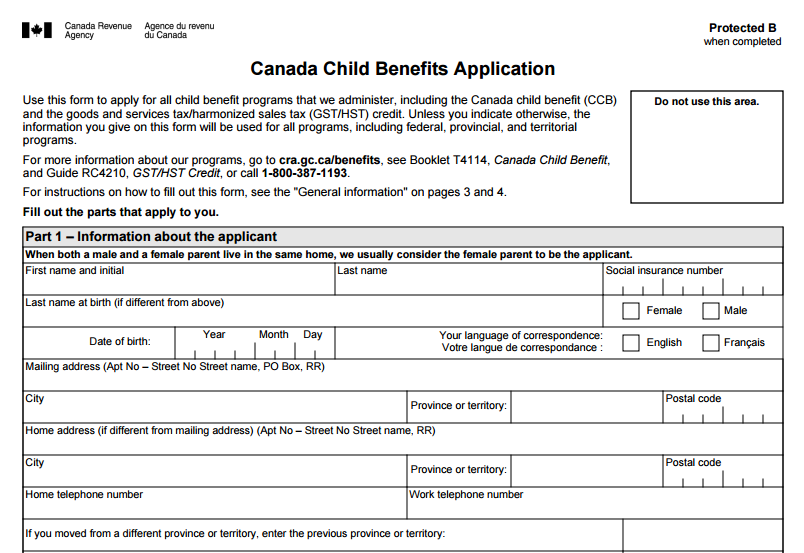

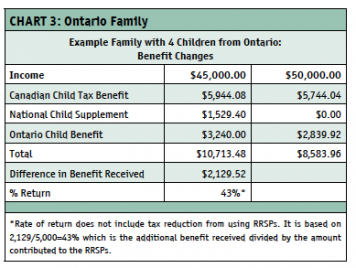

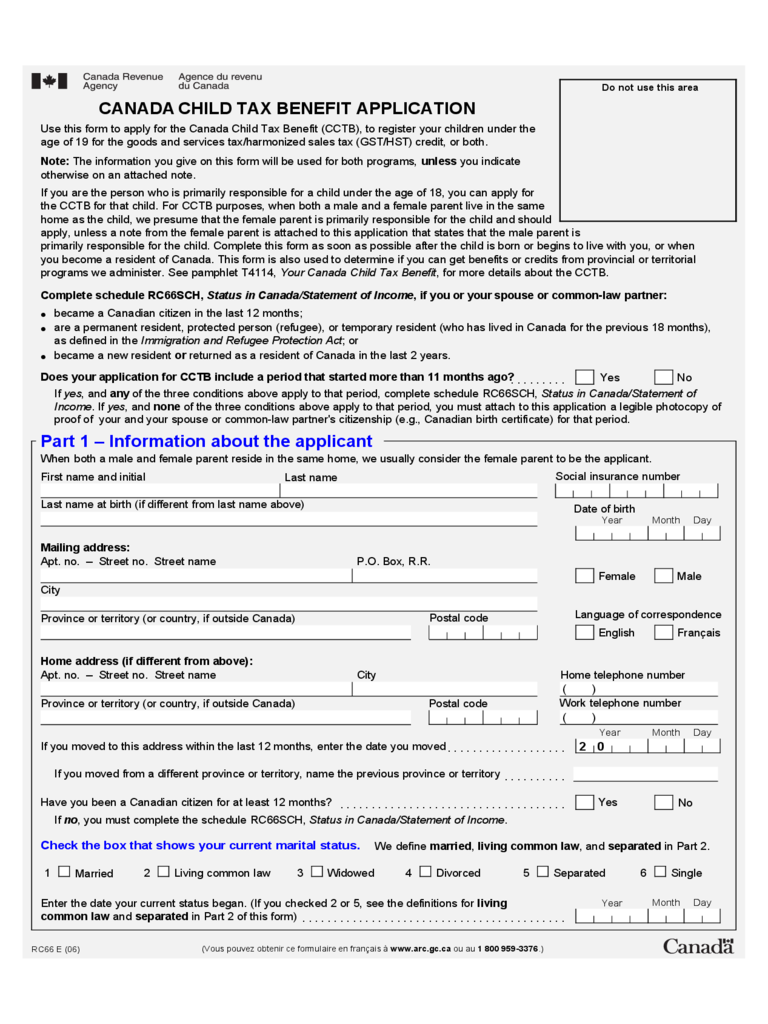

How to apply for canada child tax benefit. Apply for the canada child benefit (ccb). If your afni is less than $32,028, you can receive up to the following amounts per child: Use the canada revenue agency benefit calculator to calculate your payments.

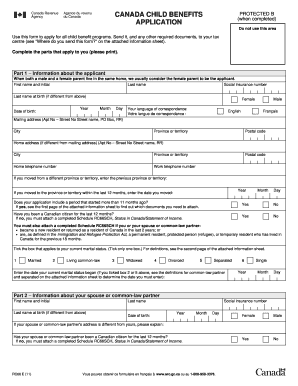

When registering the birth of your newborn with your province or territory ; Sign in to my account register. Additional papers required by the.

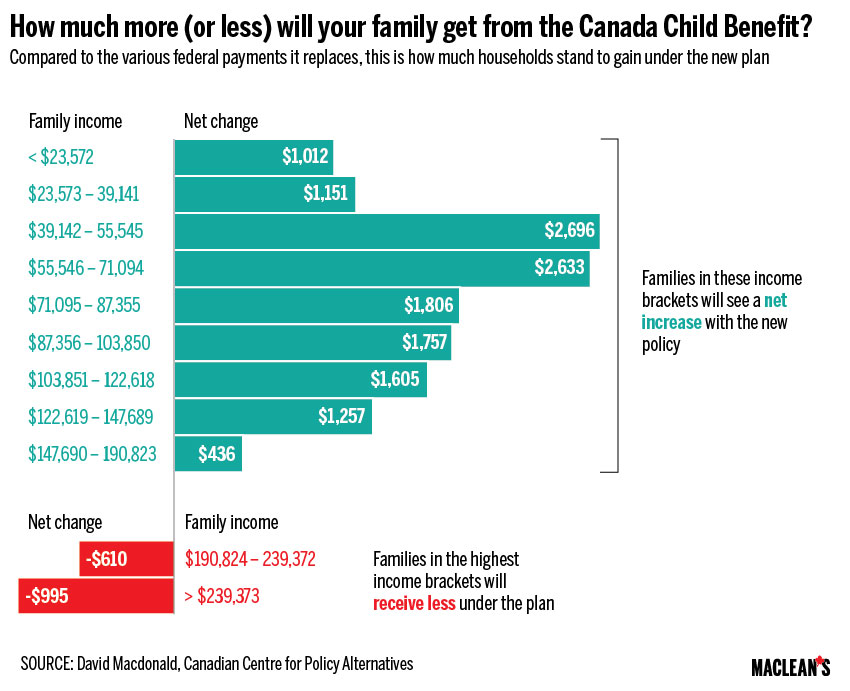

Online through the cra my. Complete the canada child benefits application (rc66) form to apply for the canadian child benefit (ccb). $6,833 per year ($569.41 per month) six to 17 years of age:.

How to apply for canada child benefit? You must file your taxes to qualify for the. You can apply for the canada child benefit (ccb) in one of three ways:

Under six years of age: To be eligible for the canada child benefit and the ontario child benefit, you must file your taxes. Every month, the government of canada provides parents with monetary support in the form of the canada child benefit, which is a cash benefit that is exempt from taxation and.

Using the my account service on the canada revenue. Canada child benefit(ccb), known as “milk payment” in hong kong, is the most familiar canada child benefit to hong kongers. If it’s been more than 11 months, you’ll.